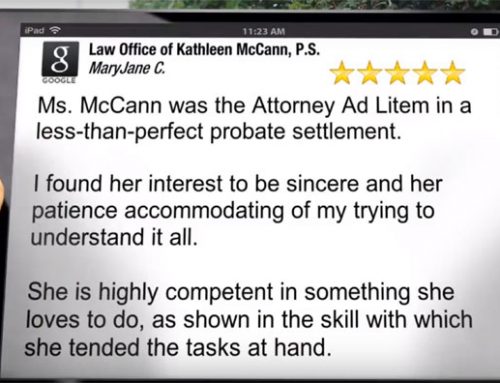

Probate Attorney Vancouver WA

When someone passes away, they may leave behind property and debts. Often, a spouse, a son, a daughter, or friend manages these final tasks and helps to distribute their estate.

When someone passes away, they may leave behind property and debts. Often, a spouse, a son, a daughter, or friend manages these final tasks and helps to distribute their estate.

Is a Court Needed for Probate?

Sometimes this can be done without a court process. Where court action is required, the process is called a probate.

Washington State has many streamlined probate laws. In some states, probate can be expensive.

Property Transfer Upon Death

There are many types of transfer of property on death that do not require a probate. Non-probate transfers include transfers under a community property agreement to a surviving spouse, transfer to joint tenants with rights of survivorship, transfers of “pay on death accounts” and transfers to named beneficiaries of life insurance, retirement accounts or annuities. In non-probate transfers, the beneficiaries make a direct claim to the account holder or manager. Proceeds of non-probate assets such as life insurance and retirement benefits with named death beneficiaries are paid directly to beneficiaries without a probate proceeding. There is also a non-probate, small estate affidavit procedure in Washington that provides transfer of assets in “smaller estates” which do not contain real property and which are under a value limit set by the legislature.

The need for probate depends on a number of factors including the value and type of assets and creditors. Transferring title to real estate requires court authority. Where title to real property is transferred or where it is sold, a personal representative is authorize to sign a deed.

In a probate there is preparation and filing of legal documents and at least one court hearing. The probate begins with a petition (petition means request) for appointment of a personal representative. Sometimes the initial petition asks for non-intervention powers.

Serving as a personal representative is a “job” with responsibilities to heirs and to creditors. The personal representative collects, manages and distributes the deceased person’s estate, pays the valid creditors and makes the final distribution to heirs.

One who dies with a will dies “testate.” Distribution of an estate with a valid will is made according to the terms of the will. There may also be “non-probate” assets in an estate with a will which pass directly to the named beneficiaries and do not pass through the will.

A will usually names someone to serve as personal representative.

If no valid will exists, the estate is “intestate.” A surviving spouse usually is a preferred person to administer marital property if they so choose.

The legislature has in a way written a will for everyone by developing an intestacy scheme, defining who should receive the deceased person’s property if there is no will and who has preference to serve as personal representative.

To read the entire article fill out this form and it will be emailed to you in a pdf document.